What card is required for money transfers abroad

You need a Tinkoff Black debit card to make international money transfers via Tinkoff. To get a card, just fill out a form on our website and enter your name, cellphone number, and your date of birth. If you are a non‑resident of Russia, you will need one of the following documents: a migration card, a work or residence permit, your visa—the exact list depends on your citizenship.

In the application, we will ask you to specify a convenient time and place to receive the card, e.g. your home or work address. The bank representative will deliver the card and your bank account documents on the appointed day. We will send a text message in advance to remind you of the appointment. You can use your card immediately after the appointment: just top up the account with cash at an ATM of any bank or transfer money to your Tinkoff card from any third-party bank’s card—there is no card top up fee.

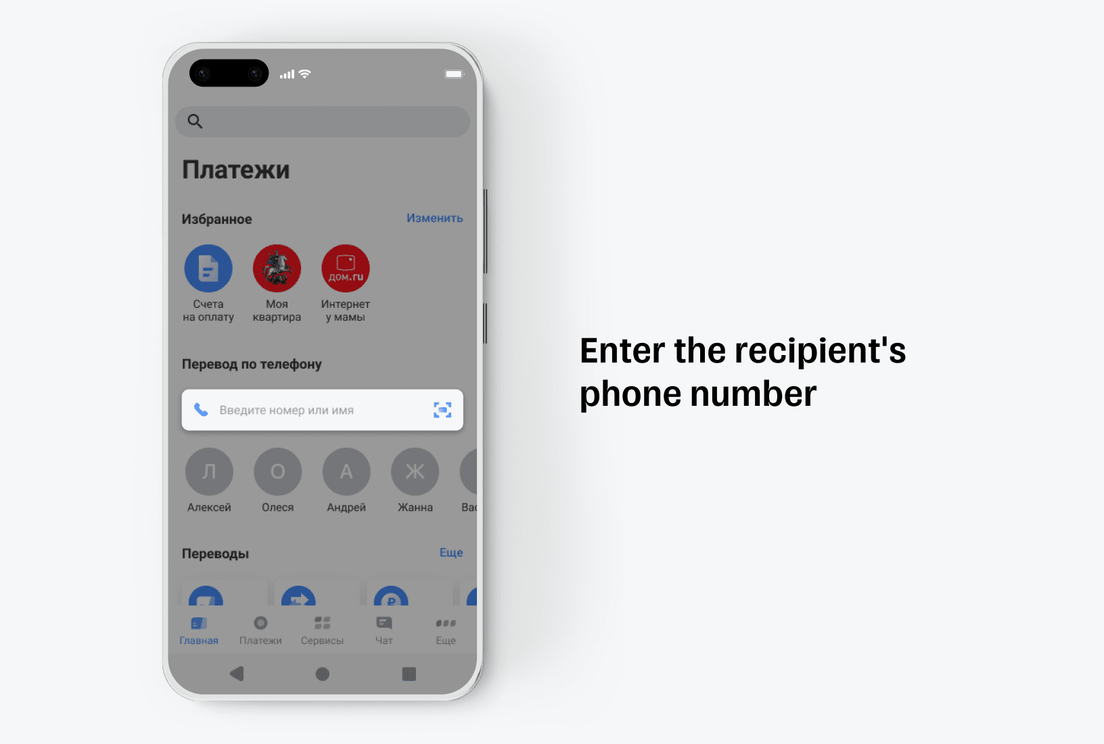

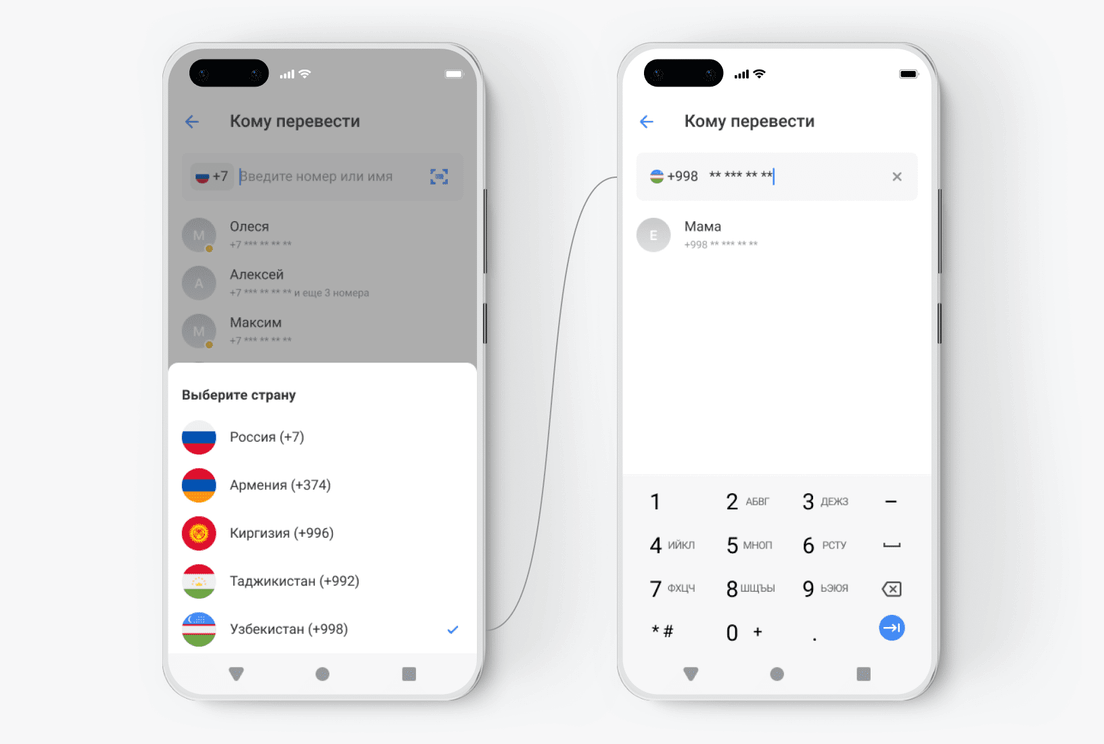

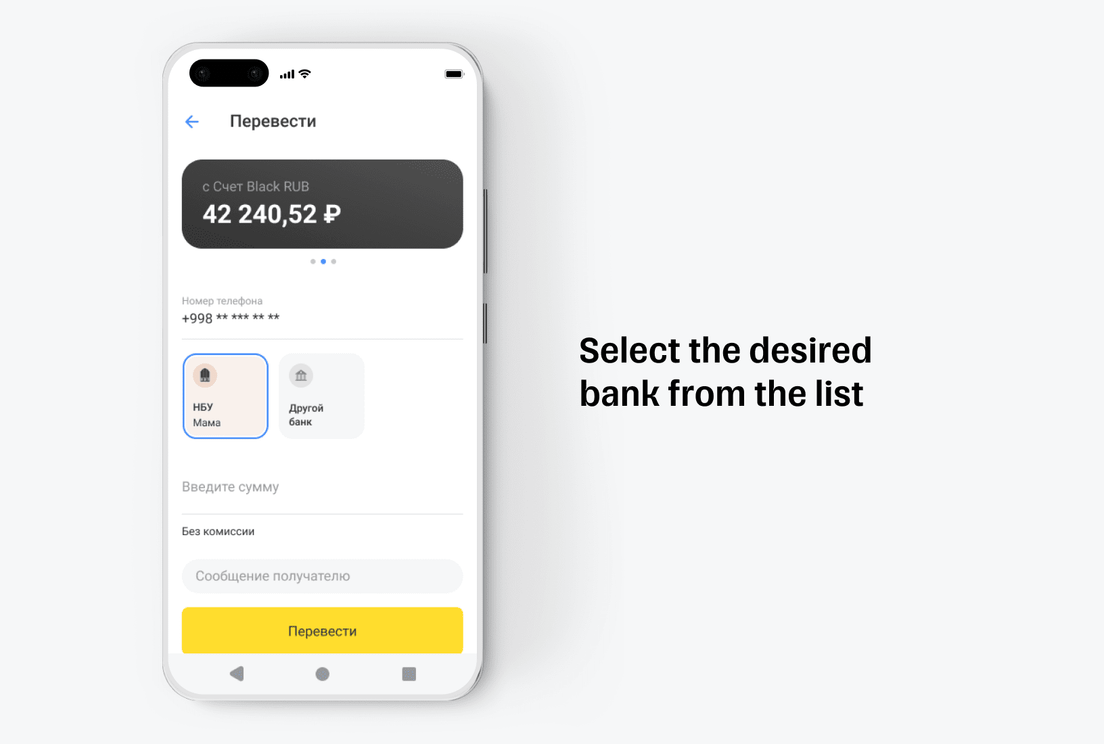

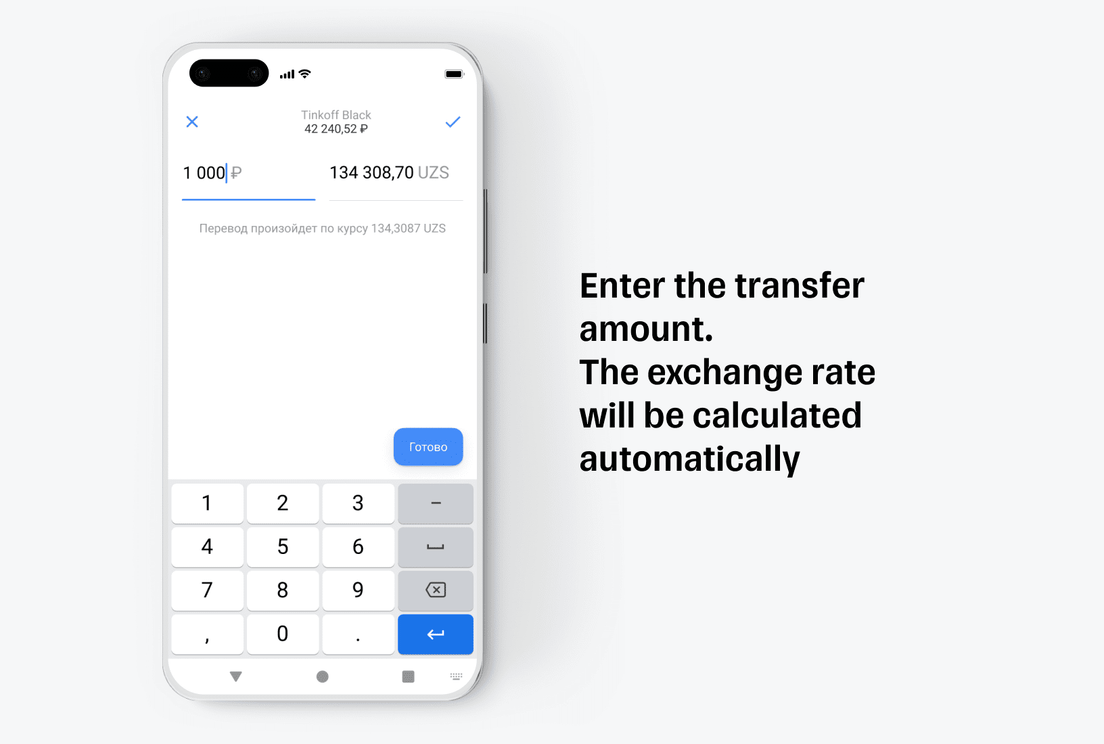

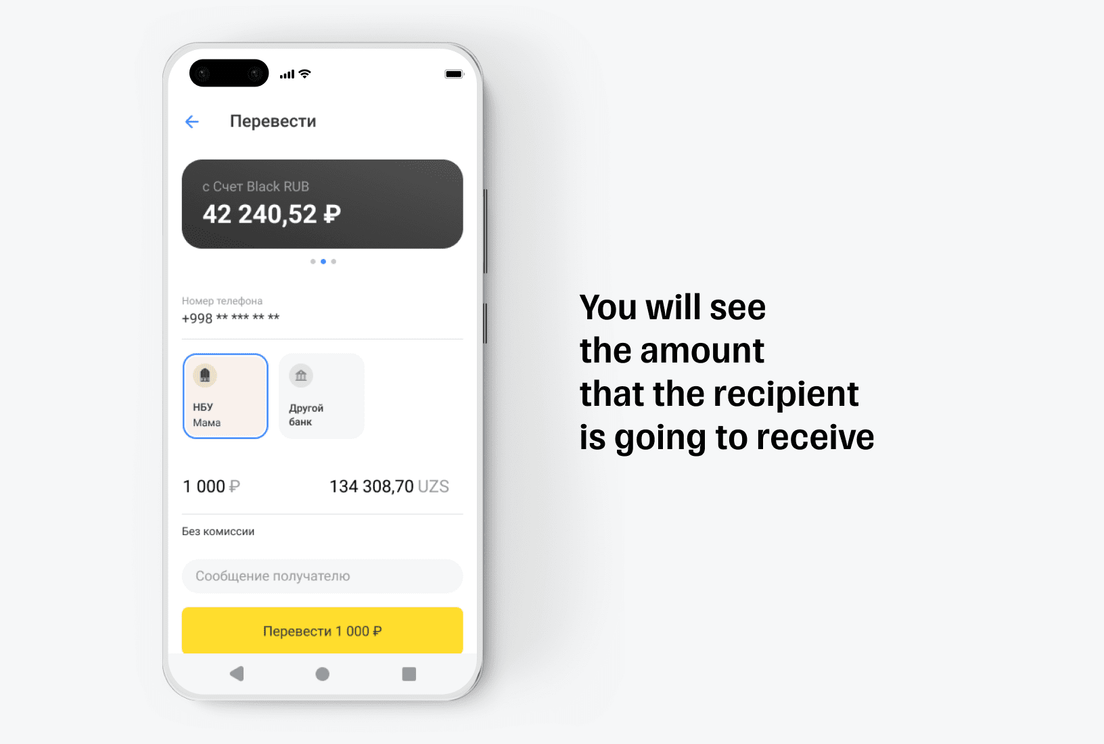

Download and install our Tinkoff app to use the card and send money abroad. The app gives you access to your account. It will allow you to pay for your cell phone services, work permit fees, and to apply for self‑employment status.

Do not use your date of birth as a PIN code. Passwords like these are easy to find out, and if your phone falls into the wrong hands, fraudsters can steal your money.